Economic Indicators: Key Updates for Financial Planning

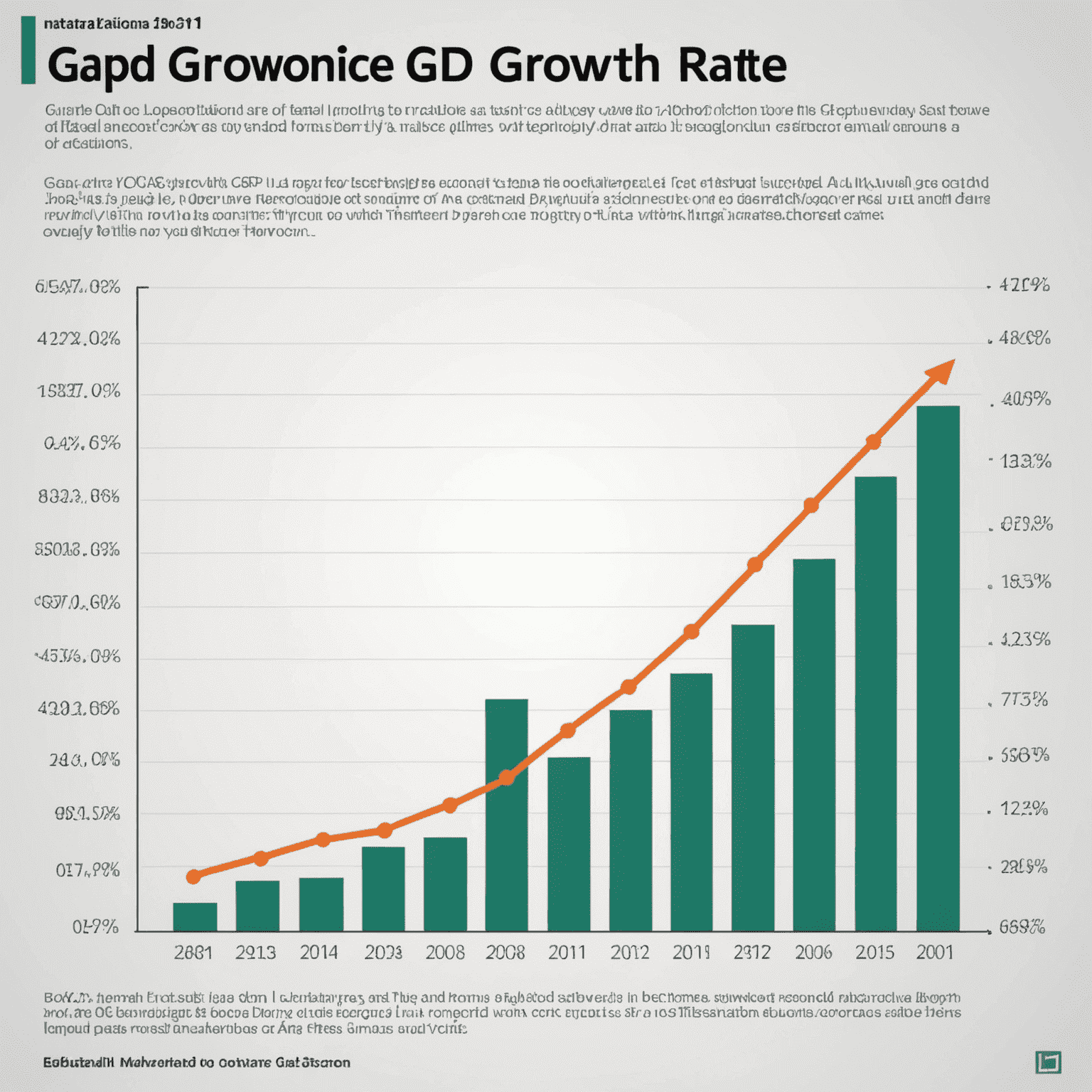

GDP Growth Rate Surges

The latest economic indicators reveal a significant uptick in the GDP growth rate, signaling positive momentum for the economy. This surge has important implications for financial planning and investment strategies.

Financial advisors are closely monitoring this trend, as it may influence asset allocation decisions and long-term financial goals for clients. The robust growth rate could potentially lead to increased business investments and consumer spending, creating new opportunities for savvy investors.

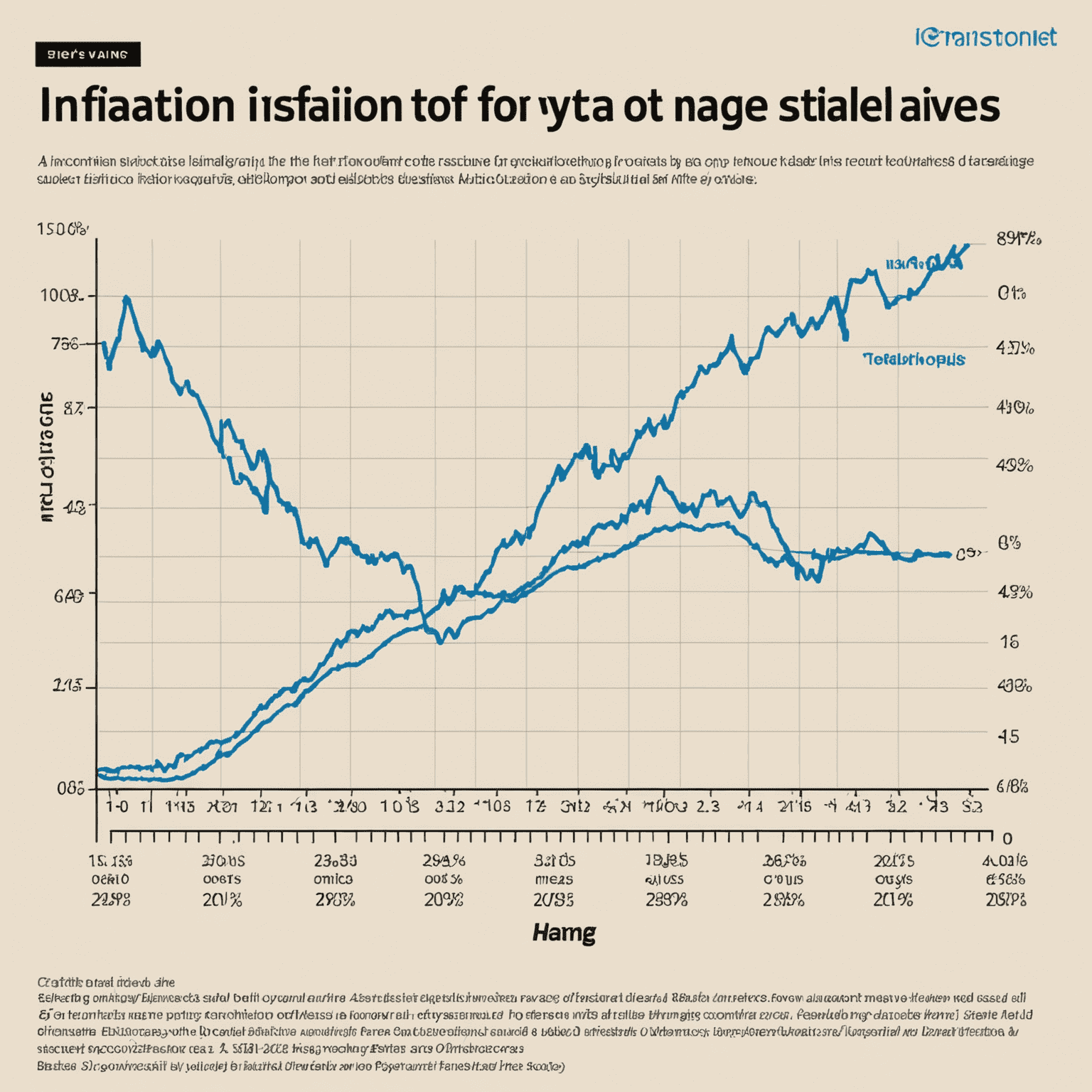

Inflation Rate Stabilizes

After months of fluctuation, the inflation rate has shown signs of stabilization, providing a clearer picture for financial planning and investment decisions.

This development is crucial for financial consultants as they advise clients on preserving purchasing power and adjusting investment portfolios. A stable inflation rate allows for more accurate forecasting and risk assessment in financial strategies.

Employment Figures Show Positive Trend

The latest employment figures indicate a positive trend in job creation and a decline in the unemployment rate, factors that significantly impact financial planning decisions.

For financial advisors, these employment trends offer valuable insights into potential shifts in consumer behavior, savings patterns, and investment preferences. Strong employment figures often correlate with increased consumer confidence and spending, which can influence various sectors of the economy.

Interest Rates: Central Bank's Latest Move

The central bank's recent decision on interest rates has sent ripples through the financial markets, prompting a reassessment of investment strategies and financial plans.

Financial consultants are analyzing the implications of this move on various asset classes, from bonds to real estate. Understanding the impact of interest rate changes is crucial for developing robust financial plans that can weather different economic scenarios.

Global Trade Patterns Shift

Emerging shifts in global trade patterns are creating new challenges and opportunities for investors and businesses alike, requiring a reevaluation of international investment strategies.

Financial advisors specializing in global investments are closely monitoring these changes to identify potential growth areas and manage risks effectively. The evolving trade landscape may influence sector allocations and geographic diversification strategies in investment portfolios.

Note: These economic indicators provide valuable insights for financial planning, but it's essential to consult with a qualified financial advisor for personalized advice tailored to your specific situation and goals.